Webinar: Navigating Electronic Payments in Senior Living

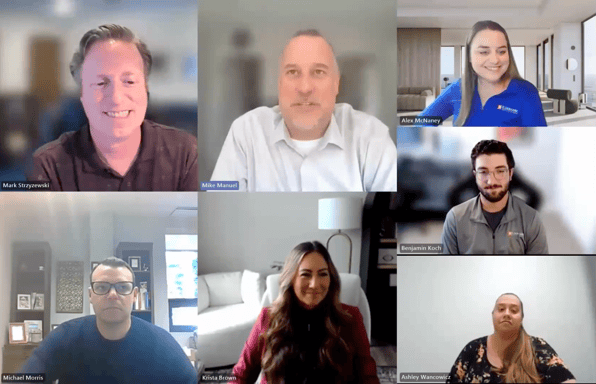

In our recent webinar, Navigating Electronic Payments in Senior Living, hosted by our very own Benjamin Koch and Alex McNaney, industry leaders gathered for a panel discussion about the evolving landscape of electronic payments in the senior living sector.

With the average cost for a private one-bedroom being around $5,350, resulting in an astonishing $4.3 billion in monthly rent payments, the need for efficient payment systems is more critical than ever. The panel featured notable voices in the industry, including Michael Morris from Willow Ridge Senior Living, Mark Strzyzewski and Ashley Wancowicz from Walker Methodist, and Krista Brown and Mike Manuel from Spectrum Health Companies. Together, they shared firsthand experiences and insights into how embracing electronic payment solutions like ePay can transform operations and enhance resident satisfaction.

Key Highlights

- Transitioning from Paper to Digital: Ashley Wancowicz of Walker Methodist described the cumbersome process of handling checks, recalling how she was spending nearly 20 hours a week just on billing and collecting payments. The move to ePay has allowed her team to reclaim about 99% of her time back.

- Faster Cash Flow: The panelists emphasized that electronic payments accelerate cash flow. One participant noted that with electronic transactions, funds could be deposited in accounts by the next business day. Mike Manuel highlighted the new predictability, stating, “We’ve seen money come into our bank before the month starts.”

- Enhanced Resident Experience: Michael Morris from Willow Ridge pointed out that residents and their families prefer the convenience of online payments. He noted, “We positioned the transition as honoring the requests of our residents and their families,” showcasing how responsiveness to resident needs fosters goodwill.

- Efficiency and Accuracy: The discussion revealed how automation reduces manual errors. Michael also shared insights on streamlining processes, mentioning, “Our cash management has improved drastically, allowing us to focus more on our residents rather than chasing payments.”

- Adoption Strategies: The webinar concluded with practical advice for driving adoption of electronic payments within communities. The panelists collectively stressed the importance of clear communication and support for residents, with Ashley stating, “We did several training sessions [with the ePay team] to ensure everyone felt comfortable with the new system.”

In a rapidly evolving sector, adapting to electronic payments is no longer optional; it’s a necessity that enhances operational efficiency and resident satisfaction alike. The experiences shared by our esteemed panelists highlight the importance of this shift and serve as a guide for those looking to navigate this critical change in senior living.

To explore these valuable insights further, we invite you to explore our ePay solution or watch the full webinar below:

Let's explore how ePay can help YOU!

Webinar transcript:

Welcome, thanks for joining us for our Navigating Electronic Payments in Senior Living webinar today. My name is Benjamin Koch. I'm part of our ePay team here along with Alex, who you'll hear from later on. I joined Eldermark this past year coming from a background in payments. I've worked for a couple different processors in the past, handling all different types of payments, including ACH, credit cards, cross border payments, even a short time handling crypto, so I have a big array of payment experience.

Today, I'll just spend a few minutes with you to do a brief overview of the current state of payments in senior living. Then you'll hear from our panel of Eldermark ePay customers and their firsthand experience with payments in the industry. And then finally, we'll wrap up with a Q&A session.

So jumping right into it, I'll start by talking about the general cost of senior living. The average cost of a private one bedroom is five thousand three hundred and fifty dollars and currently there are eight hundred and eighteen thousand Americans residing in assisted living facilities.

When you put that together, we're looking at about four point three billion dollars in senior living rent payments a month. That's over fifty billion dollars a year. And as you can imagine, that is a lot of money exchanging hands on a monthly basis. So having good tools and strategies in place to collect, track, and forecast this cash is, imperative, for some of the reasons I'm about to walk you through.

Historically, paper checks have been a popular method to take rent payments. And although it can be low cost, it comes with its own challenges compared to electronic payments.

With checks, you know, you get your statement, you write the check, mail the check, hope and pray the check arrives safely and on time, and then repeat the next month. With electronic payments, you get your statement, go to the Landmark portal to pay, put in the payment info, and then get instant confirmation of a successful transaction.

So as a community, both methods will get you your money. But for the residents, the ease of paying online and the security of knowing the payment was confirmed and accepted within seconds is why we're starting to see a trend of residents preferring to pay online.

So now that residents have responded with the introduction of e-payments, electronic payments.

So, here's a graph of the trends. In the last twelve years, there's been an over one hundred and fifty percent increase in digital payments. That's because it's how residents want to pay, and now it's even because of how what residents are expecting to pay, especially younger members of their family who may be helping with, you know, a bill, for example. So today electronic payments make up roughly eighty five percent of all payments in the senior living industry. So this is absolutely something you guys should be looking into for your community if you haven't already.

So we've established that electronic payments make a better payment experience for your residents. But what about you as as a community? I was speaking with one of our panelists, Ashley, from Walker Methodist a few weeks ago. She was telling me, but before they adopted electronic payments, she was spending close to twenty hours a week just on billing and collecting payments.

Most of that came from manual entry she was needing to do to send statements, deposit checks, update billing software, track down checks, you know, fix any errors. I could go on. The list goes on from there. But once they switched to electronic payments and automated all that, you know, she got close to ninety nine percent of her time back.

It all pulls that information and payment info directly into their billing software. And now she just clicks a button to batch out the payments and they have their funds in their account the next day.

So that leads me to funding times. So with with paper checks, you send statements. First, you have to wait for that check to arrive and then, you know, another three to ten days to actually get that cash deposited into your bank account. Whereas with electronic payments, residents can pay immediately once they receive that statement, and then you have cash in your account in the next business day. So not only does this get you your cash faster, but it's more predictable. It helps with cash forecasting and knowing when you'll have cash on hand ready to use.

And now finally, what does a good e payment system for seniors look like? Firstly is giving a variety of payment options. Right? It's important to give options on how to pay. Although we are seeing trends of residents preferring to pay online, there are definitely outliers out there that prefer to write a check. So having a software that can accommodate paper checks, ACH credit cards, all other digital methods ensures that all of your residents will be happy and accounted for when you implement something like this.

Next is ensuring things are secure. Seniors are a huge target for financial fraud and scams, so anything you can do to limit their exposure helps keep them and their money safe, also helps instill trust in your community. So this includes things like tokenizing payments, which stores their payment information, securely without getting any individual access to all the payment details.

And then next will be ease of use. This is huge, especially in the senior living industry. New technology, as you guys know, can be hard.

So making the steps residents need to make payments simple, easy, and clear is extremely important to make sure that they don't get stuck when making any payments online.

And then finally is a family friendly solution. So many residents rely on support for family members to help make payments, so providing an option to split payments or make partial payments helps make that process a lot easier on the residents and their families, as well as, you know, your community staff and the billers. So, now let me hand it over to Alex to introduce our panelist.

Fantastic.

Well, thanks so much, Ben. And now we're going to get into the fun stuff and hearing from the panelists. So, just a quick introduction of myself. My name is Alex McThingi, and I have been with ElderMark for just under two years.

Throughout my time here, I have been hands on with essentially everything that touches the digital ePay landscape. So implementation, operations, customer success, support, analytics, some of the sales.

But really this diverse experience has helped me get a well rounded understanding of what it takes to help organizations transition smoothly to electronic payments and to maximize their success.

Now, I would love to extend my thanks to our panelists, not only for their partnership, but also their willingness to share their experiences with us today.

So without further ado, I'm going to kick off the introductions first with Michael Morris, who is the president and CEO of Willow Ridge Senior Living, who partnered with ElderMark in twenty twenty one.

Now, as a background, initially they launched a single site with us. However, they have since grown to twelve active communities and have a proven track record of turning around economically distressed buildings.

Their growth story is truly inspiring, and they are shaping up for twenty twenty five to be their biggest growth year yet, so much more to come.

It's a pleasure, Michael, to have you here today. So thank you so much for sharing the Willow Bridge journey. Is there anything else that you'd like to add to that?

No. I think that pretty much covers it. Thank you very much, Alex.

Fantastic. Thanks for being here.

And then next, I'm honored to introduce Mark Strzewski and Ashley Wankowicz from Walker Methodist, a longtime partner of ElderMark.

Now, Mark is the Director of Business Intelligence and has been with Walker, as well as I believe ElderMark for over thirty years, playing a key role in managing integrations and data across their communities.

And joining him is Ashley, the accounts receivable specialist who oversees billing for nearly all of the communities. And she's background, Walker Methodist has also experienced significant growth this year through their merger with Knut Nelson and forming a partnership of equals, if you will, across the nonprofit space. So they were previously operating across Minnesota and Wisconsin, but this merger has expanded their reach also into the Dakotas. So, Mark and Ashley, very excited to have you here to share your insights.

Anything additional that you want to add, either from Walker Methodist or Knut Nelson?

No. Thanks, Alex. That's an introduction. Thanks.

Thanks, Alex. Sure.

And then last but not least, I'm thrilled to introduce Mike Manuel, managing director, and Kristof Brown, vice president of operations.

As a management team, they oversee Spectrum, a key player under the Spectrum Health Company's umbrella owned by Merle Sampson.

They operate twelve community buildings throughout Minnesota and primarily serve elderly waiver and state funded residents with approximately five fifty beds.

Now since Mike and Krista took over management a year, I think we're on the same path forward of a growth year. They've since added over one hundred residents increasing to their overall occupancy in less than a year. Now, while rapid growth sometimes can bring those growing pains, they've successfully mitigated these challenges by implementing automated processes rather than solely adding more staff. So excited to have you both, Mike and Krista, to to share that journey, and the strategic steps that you all have taken to scale Spectrum successfully.

Anything either one of you wanna add to that?

No. You covered it very well, I think. Thank you.

Thank you so much for having us.

Yeah. Glad to be here.

Fantastic.

Well, with that being said, I am gonna stop sharing my screen. Now that we've introduced our panelists and their organizations, let's explore the initial phase of operations and start by discussing how did you manage these payment processes before the introduction of electronic payments?

Now, before electronic payments is very much so still a scenario, common among many senior operators today.

So, Mike and Krista, I'm gonna kick it over to you all to get started. So let's just paint a picture of how you ran your collection process previously.

Well, I would say that ours was a pretty complicated process.

We really hadn't, nobody looked at it, for a very long time. So, I'm sure, there's other organizations that can share kind of how we did things. But it was, we would give a paper statement.

And then from the paper statement, we would collect checks at the local site level. We have twelve properties as you mentioned, and each site was responsible for collecting basically paper checks. We could we could take, a credit card online, but it was complicated. It was hard to find on our website. I mean you really needed to know how to do it so we could be done. But it was it was also just very clunky.

But the other piece that then happened was we would deposit those paper checks at the local bank. Obviously we you know we didn't have a scanning system or anything. So basically what was happening is our local people were running me the bank and and cash flow is important as everybody, knows. So they were we we expected them to run to the bank every day. I mean, if you had a stack of checks, you don't wait till Friday. So, you know, if you had three checks, you ran those three checks over there.

And so we had a lot of, obviously, as you can imagine, just time people running to the bank.

And, you know, as you can imagine, sometimes people run to the bank and maybe they catch one or two other errands smother out too. And so there's that lost time too is that that, you know, you can only imagine there's some of that as well. But, then what would happen is we would then have to pull that money from those twelve locations into a central account, which also took time and, you know, labor as well.

I think that about coverage that, Krista, do you have anything to add to that?

The only thing that I would really add is through that manual process, there's also so much opportunity for error. So as we're depositing those checks, if not every single check is accounted for, maybe we miss a deposit that gets missed on the resident's account within ElderMark. So it it causes a lot of opportunity for error.

Yeah. I think I'll thank you, Krista. I'll to to add to that. I mean, just even linking a deposit to a resident can be complicated when you do it that way as well.

Right? So it goes into a local bank with other deposits, then it gets transferred to a central location. By that time, it's just the money's all mixed in together and it's very hard to track unless you're doing it manually. And, yeah.

So there's definite room for error and it's very complicated to to keep track of.

Yeah. Absolutely. And really what it comes down to is there's, of course, check payments. But what we would call that process is more of your traditional banking where you've established relationships with the bank, but it really doesn't come with any of those premium services like being able to assist with some of that human error elimination. So, we'll get into premium banking here in just a minute. But speaking on track with the traditional banking, I know Walker Methodist, when you all started your conversion in December of last year, you all had a little bit of that traditional banking mantra with the relationship with the bank and some of those manual processes. So do you guys wanna help me kinda create that picture and talk about what you all were doing before?

Sure.

I I can start. I suppose, actually, fill in as you as you need.

So in addition to the manual check processing, like Mike and Krista mentioned, we did have a check scanner, which did assist with some of that, but it was still there's still a lot of manual processing that even goes with that. You don't have to make that trip to the bank necessarily unless the check doesn't scan or something, which certainly happens.

But you've still gotta match everything. You've still gotta manually enter things.

Walker also had, depending on the community, maybe fifty to seventy five percent of our residents already on ACH, roughly, depending on the community.

The difference there, though, is that we had a manual tracking spreadsheet for each person that was on ACH. Somebody would update that spreadsheet each month with the balance that their statement had. They'd send that spreadsheet over to somebody else in our accounting department who would log in to the bank's website, key in that ACH.

And then once the ACH cleared the bank, somebody else would manually key that payment into, Eldermark. So even though we had some ACH, it was still a very manual process.

It was a very time consuming process. And we also were only able to do it the one time per month. And so if something was missed or there was a new person, the cash flow just wasn't there. We did have to wait, pretty much an entire new month to get that to get those funds, which, was never good.

And, Ashley, you're in the trenches, if you will. Right? So you're very hands on with the process, and you can kind of feel what that transition was. So Ben mentioned a little bit, and we'll dive really far into the banking, the premium banking, if you will, later on. But Ben kind of alluded to saving some of that time. So tell us a little bit about what that transition looked like for you because I know you were managing just a handful of communities, and now you're essentially managing them all to some capacity. So how much staffing hours do you feel saved you from that manual process?

So we definitely would have needed to hire an additional person. And so that was, you know, considerable time savings on our part.

It is something that we're able to we don't have to key and batch all of the payments is really just a couple of clicks now. And that was taking a considerable amount of time before, and then having the ability to, just email somebody a link to their statement, and then get the payment. And so that phone call can take five minutes instead of trying to, you know, track down their checks and explaining.

And so even just the collection efforts also are much much easier, and much quicker to, to give to those family members and then also just to physically do the act of keying in the funds, which we don't wanna spend all of our time doing data entry.

So it is a a huge time saver on something that's a pretty low level task, but was taking up a lot of hours every month for every person who did billing.

Yeah. I see some head nods from the other panelists, so it seems like it's definitely been something that they felt too.

Mark, just one more question for you and then we'll, we'll shift gears a little bit. But being an integration guru, right, you deal a lot with the technology, I would love to hear what convinced you that digital payment should become a priority, especially given that you already had some electronic payments just in a traditional way, upwards of fifty to seventy percent?

Yeah. We we had tried to do some integrations on our own, if you will, using some ACH software, but that was proven to be very clunky just trying to do it where, you know, having something that was built into the software was very appealing to us rather than having to build our own integration through some other ACH software.

And, you know, as Ashley alluded to, as as Walker has grown and added management communities and stuff, it it needed to be seamless. It needed to be timely, and and just trying to do something on our own was not not feasible.

So Yeah.

And I know that when we had spoken too, you really broke it down well into two different categories. You've got your internal efficiencies and improving those workflows and the manual process elimination that we can all shake our head and agree to. But then you've also got this external piece where it's your residents, their families, and how do we stay competitive and remain with our resident satisfaction at high results.

Yeah. And and everybody, I mean, no matter what we're doing, whether we're paying any, utility bill or a medical bill at a clinic for a doctor's appointment, whatever we're doing, we're we're everybody's doing it online these days. Everybody's doing that processing just by going to a website, clicking a link, or setting up an automatic payment for utilities or something. So it is it is the way things the way things are these days, and and we need to to get we needed to get with the program.

The ways of the world, if you will.

Yes. Exactly.

So speaking of resident demand, Michael at Willow Ridge, when you started back in twenty twenty one with some of those buildings through Elder Mark, you guys were accepting a hundred percent checks, without any ACH or card acceptance. And your experience was actually moved forward because of the families who expressed an overwhelming appetite for something like this.

So do you wanna create a little bit of a picture there for how you guys experienced it with Willow Ridge before and after?

Sure. Thanks, Alex. So we acquired a community in twenty twenty one. It's, far western New York, and we got a lot of requests from residents and family members looking to make the change.

And so we sort of positioned the the transition over to Elder Mark and ePay as a, you know, appreciation and, honoring the request of many of our residents and family members. And just to sort of piggyback off of what was already shared, we're in far western New York, very rural, market that has rural mail carriers. And so the postage system is very unreliable in so many respects. And so family members that were either out of town and sending in their paper checks, they were having difficulties with, checks not arriving at the community, and then you layer on those additional complexities of check scanners and manual trips to the bank.

And so we were getting these requests from family members and residents to say this process is unreliable. So when we rolled it out, it was so very well received and it was a you know, we were able to position it as, you know, we heard and, you know, we're gonna take action on your request. And so it went over very well. And so we use those same hurdles that we experienced with the manual check process in acquiring new participation in the program as well.

So, I think that's a great segue for us. We've heard about the traditional banking, and I have alluded a little bit about premium banking. But let's talk about the evolution of what that looks like. So beyond some of the obvious benefits of modernizing your payment processes, there's also several key factors that make electronic payments increasingly attractive.

It could include enhanced efficiency and speed, greater accuracy, reduced errors, improved security, better record keeping. I mean, the list goes on and on, and it's actually a list that you guys have already mentioned as to a little bit of why you made the transition. But again, there's a lot of senior operators today that haven't yet made this jump because change can be scary. So speaking of that change, in order to get those benefits, really the first step is completing that daunting system migration.

So I would love to hear from your experiences firsthand, having made the migration through ElderMark. How did that really impact your families, as well as the communities on-site and how they've responded to these changes? So I'm gonna send the ball over to Kristin and Mike first, just because you guys have had the most recent migration, and would love to hear a little bit more about what that looked like and and how you got it in front of your residents.

Well, I guess we, I don't know how common this is with with other, with other companies, but, you know, I've I've worked with with different companies and I feel like it's pretty common about what I'm about to say, which is, nobody wanted it. And I think it's just because nobody wants change.

I shouldn't say nobody wants change, but people, in general, it's it's difficult for them. Like, they they have a routine, they bring in their check. That's what they like to do.

So that's the family and the residents. We're we're not really excited about it. Our staff was not excited about it. They wanted to just kinda do the thing that they've been doing too. And everybody thought, oh, this sounds complicated.

I fast forward till the very end, and then I'll give you the middle, but fast forward to the very end. I would say ninety six percent of the people, ninety six, ninety seven percent of the residents, families, staff that, that were the ones that I was just describing that weren't excited about it, like it. So, that doesn't always happen. You know, when you do implement a change, people are sort of sometimes looking for reasons to not like it or looking for broken, this is why this doesn't work, I told you so kind of like, there's always that. And, we didn't really have that.

And and it was, it was well received. So to to but to go back to the answer to your question, it was, the first thing we needed and we wanted to do that, which is to really, we didn't need all the local banks, especially in our markets, which we have some very small markets.

The bank was not sophisticated. And so it was hard to just even just continue to have that relationship with those local banks. But we we needed it because of the way we were doing things. So, having, ePay enabled us to have all of our deposits go into into one account, which was that was the the biggest help right away was just getting all the all the cash flow to go to one place, not to twelve places then to one place.

And so that was a huge, thing. And the actual implementation, because of the way that, Alex, you and your team, set us up and and was, was was seamless. And what I mean by that is you guys had forms for everything. You had, cookie cutter letters that we could change and modify if we needed to.

You had an implementation process. You had something for everybody. This is what you communicate to the families. This is what you communicate to the residents. This is how you talk to the staff about it.

So one of the things that that Krista and I loved about, this process was just simply that, it was sort of just in a nice folder, kinda pull down what we needed at the time we needed it. And here's what you do next, and then do this, and then do this.

You know, we we implement a lot of different, processes. Most of them obviously automated electronic as we move forward. And, the ePay specifically was seamless and it was very easy for us to implement. And then our staff liked it because it was clear.

And, yeah. So first round, very first round, we we got a huge amount of buy in from, the residents, the families. We got most people on it. And I would say by the third month, Krista, I will ask you what our what our capture rate is now, but, we have a a overwhelming majority of people are do it using ePay now.

Yeah. We're we're, upwards of seventy percent utilization currently.

We have not made it, mandatory yet at this time. This is just individuals that are voluntarily, signing up with that payment processing.

So, yeah.

The other the other cool thing that we've seen is that, we have people now with ePay just just having that easy process to use. We're actually getting paid earlier, than than than we, you know, before the month starts. We're seeing money come into our bank before the month starts. And as you can imagine with paper checks and stuff, that wasn't that just wasn't happening. So that's also a nice thing to see. It's not a huge amount, but it's certainly pushing it the right way.

Yeah. Yeah. The pre bill where you're posting your statements earlier into the month, because of these premium banking methods where somebody can click and go online and pay at their leisure, sometimes when I get a bill as a consumer, soon as I see it hit my desk or my mailbox, I'm just going to pay it so that I don't forget it. So, you do tend to see some of that as a result.

So really appreciate your feedback. You guys bought into the program and launched all of your buildings at once. So, so happy to hear that it was seamless and that that was your experience. And, I know for Walker, you guys did a mass majority of your buildings as well.

But what was a little bit different about it is you guys did it in December of twenty twenty three. You really wanted to start the new year with the bank, but obviously in terms of budget and and cash and those types of things, I'm sure that that could have been a scary change. But what did your experience look like for you all with making that transition?

I think that first month was a little scary because we were bumping up against the payroll, and we needed to make sure those funds came in for the payroll. It all worked out. It was it worked out wonderfully, actually. But, there was a little bit of on edge that first first time around.

From my perspective, the implementation went flawlessly. I mean, we're able to take the ACH information that we were already using, the spreadsheets that have been put together, and Alex was able to incorporate that. So those people that were already on ACH really didn't notice anything.

You know? The the what appeared on their bank statement might say something slightly different than it did before, but they didn't notice anything. And then it was just a matter of getting those other people to take interest, those other residents and family members that hadn't hadn't signed up for ACH previously, getting them to have interest in in doing the doing this. So, Ashley?

And I think that, our staff has been really excited about it since the beginning.

And then right away, we did several trainings with Alex, for everyone to make sure that the people who were gonna do it actually understood the process.

And so from, like, a billing perspective, I think that really made people feel more comfortable with it.

And then our residents, the ones on ACH, like Mark said, they didn't notice any difference. It was just a very seamless transition for all of them. So nothing scary from their perspective.

And then as we've gone through, each month, more and more residents and families are going online themselves, and people are setting up their own recurring payments, and so doing it all themselves. And we started mostly it was family members, and now a lot of residents themselves are excited and personally are setting it up. And so it's easy enough that our elderly residents can set it up themselves.

And it just, like, I sent out statements, and the next morning, I came in and saw in my portal that I had five new payments for, like, almost every site because they received their email immediately clicked on the link. And so definitely something that the more people use it, just we're getting more and more residents that are using it as well. So I think that says a lot for, just the ease of use.

Yeah. Thanks for that feedback. I know that that's always part of the scary part of change is how is this going to impact my residents?

And we're dealing with people's money and money is not something to take lightly. And we understand the responsibility it takes for that, which is why we want to make sure it's as seamless as possible. So, really good points. Thanks for adding your feedback there.

And then Michael at Willow Ridge, I know that your force building was, quite some time ago. Right? But you have been adding building over building over the past, I would say years, but also in the past few months. I think last month you had almost five buildings come on. So you guys are scaling that implementation in a little bit of a different way through your expansion.

I know that you guys have some organized processes on your end and reference guides to make sure that it goes off without a hitch. But do you mind sharing a little bit about what that implementation looks like as you add new buildings or even offload other buildings?

Yeah. I think we draw a lot from our experience on the first on first community. Communication around any change is obviously critical. So we in that first building, put out significant advanced communication around what the process is gonna look like, however you spelled it out, over communicated on exactly what, you know, the the first implementation was going to look like.

We draw on that experience, and as we go through new, new community acquisitions, we have a very refined process. We have just an acquisition checklist and, you know, accounts receivable has their own their own part. We have specific, you know, ACH forms. We have the, unit configuration that goes into ElderMark.

We have the, the uploads for all the billing contacts, and we've made pretty much every mistake that you could probably make. So we've learned from all of those along the way. And, you know, there's there's just certain things that will never happen again because we did it, you know, the wrong way the first time, and we've learned from them. And and so I think that, experience, we've been able to leverage upon to to make each new acquisition, you know, much smoother as a result going forward.

And, again, I think for us, we always have this thirty day transition period before any acquisition where we get to work with either the exiting operator or the seller of the building, and we get that thirty days to really make sure we have, solid ground underneath our feet before that first ACH pull and before, you know, before any any type of payment is due because that's you really have one opportunity to make a good first impression, and the last thing you wanna do is the first of the month to go by and you don't collect their first payment or you over pull or something to that effect that could be very devastating on your first opportunity to make your company's impression.

So those are are things that we are very specific on. We have a very, you know, regimented process of cross checking. So statements versus, the number of residents that are on ACH and and making sure that you're not, you know, pulling something that is an erroneous dollar amount because the statement is is wrong. So really cross checking and having multiple eyes on the process.

That's another takeaway that I can really, draw from our experience on is that one person might be able to to pull a list of statements, and you can cross check it to a certain degree. But that second set of eyes really looking on, you know, large amounts of money that are gonna be pulled, I think is a very a very good best practice.

Yeah. I mean, just all of the processes that you've implemented, it it truly is impressive. I've gotta say there's so many times that even at Eldermark, we look to all of the panelists here. But Michael, I know that we've had conversations with you before.

And even when we think about just standardizing across the board of adoption, adoption is a huge question mark, and how you can leverage that to maintain the staff that you've got. We've looked towards your direction about rolling out some of the implementations that you guys have done towards adoption. And really the biggest thing is that incentive is driving the behavior with public appreciation. The only way that you can do it is to have the eyes on the business.

So, yeah, you guys have done a great job there with all of your reports and knowing where you're at with the business. So that being said, some of the strategies I can think off of my head, are the late fee waivers or adoption contests.

So do you wanna share a little bit of light about that incentive driving the behavior and and how it's transitioned your guys' adoption?

Yeah. So there's two or three things that come to mind right out of the gate that help us really with the participation percentages. And the first is we do, much like many operators, annual rent increases for our existing our existing residents on the, first of every year. We do them all at once. And with our population, we naturally, like many operators, will get a lot of pushback, family members that are asking for a concession on that percentage of an increase. And if we are going to make any concession on what the budgeted rate increase is gonna be, we will honor it, but you need to sign up for autopay. And it helps reassure, you know, timely collection of our payments.

You know, they may not even have a, you know, history of, you know, delinquency or any arrears, but we would rather just make sure that we, you know, protect ourselves, increase our percentages by making that concession.

We are, as you mentioned in the beginning, very much a turnaround operator. So we take on very operationally distressed assets, sometimes in foreclosures, sometimes in, fire sales from an operator just needing to get out from underneath their debt. And we work very, well in those difficult situations. So discount utilization and incentives is something that is very, prominent in our world. So when we're doing any type of a rent concession on the front end to jump start occupancy, the ACH is a mandatory, you know, is a mandatory component to that. So we'll sometimes do burn off incentives where we'll offer a month for free or sometimes more permanent discounts where we'll, you know, reduce rate on the front end or waive a community fee. And in any of those scenarios, the ACH is a is a mandatory, you know, component of that incentive.

The different contests that we've done, we've put out some really big, you know, dollars. We've worked with Eldermark. We've done different types of parties for our our communities where the we've kind of put them against each other and run a contest. Whoever can get the most, you know, most competition.

Most, you know, enrollees over a specific time period will get the reward, and we have a very competitive bunch. So it's worked quite favorably for us, and and we have fun with it.

Definitely love, you know, kinda getting each the other teams, you know, against each other, and we have a lot of fun with it.

Yeah. That's great. And speaking of adoption contests, we've, taken that same initiative and rolled it out. So I know that Walker Methodist and Spectrum have been involved in our adoption contests.

And actually one of your buildings, Mark and Ashley last month had won the contest of August and received a taco party for their team. So not sure if you guys have heard any of the feedback from that, but anything that you all wanna share from that experience?

Yeah.

I think we kicked off those those contests with kind of a reeducation of the marketing staff, the resident services staff, the business office staff, the executive directors of those sites, And I think that alone helped. And then, you know, posting signage at the front desks, posting signage in the break rooms, posting signage wherever it's appropriate, along with sending out notices with statements or something saying, hey. This is available, has really helped increase that adoption rate.

So yeah. And it's it's and I know it's been kinda fun for the staff to to do that.

Yeah. Something I heard from your team was, it takes a whole team, not just the billing group. So you guys have a resident services group. And even though they don't have access to the Aldomark system, they're not actually going in and doing anything with the statements.

They're still in front of residents and their families. And so everybody can speak to the same drum and promote that adoption. They just need to work with their colleagues to figure out how to get to that end result. So, it's been really great to work with your teams and get in front of groups that we may not have gotten in front of before.

And then I know that you guys are also kind of toying around with the idea of what are other ways for us to leverage these types of payments.

Maybe on a recurring basis, of course, you have your monthly rent, but you at Walker also have SNIP centers. So I understand that we're kind of elaborating a little bit there. It's, not perfectly sorted out. But that is something interesting to think about different ways to collect.

Yeah. We're starting to explore that those those that option of of using this system for collection or for monthly billing, and collecting of the money, for those SNF communities.

So yeah.

And and then I know, in terms of some other strategies, you can leverage, your security deposit. So I think inherently a lot of folks will just pay those with check, depending. I know that there's some state regulations where you have to have a check. But in the case of that, you don't have to or fall in that category, the electronic version is providing their immediate security in the sense that, you know, that they've got the money to live in the building and, you know, their interest levels of if they really want to move in.

Now as we're winding down, I'm really curious since making the switch to electronic payments, has a more predictable cash flow opened up opportunities to reinvest in your communities or in your people or anything in terms of your business? And looking ahead, what's on the horizon for you? Are there any new projects or plans now that you've got that steady cash flow? So I'd love to hear what's next.

I'm gonna start with Christa and Mike. You guys kind of alluded to something about this before, but within your guys' ninety days, you've accomplished a significant increase in that cash flow. But not only that, you guys have moved eighty eight percent of your money from the middle of the month really to the first of the month and even some of it a little bit before, which we talked about. So what are your guys' plans?

And tell me a little bit about how that's helped you all.

Well, this is this is the most exciting.

And first, I wanna say that Chris and I did talk beforehand, and she did say that I field the question first, and then I hand it to her. So I wanted you to know I'm not trying to dominate the conversation.

That was there was a strategy there.

I love it.

But, but I, yeah. So I'm very excited to talk about this because it it has been, and we didn't know before, we were excited about it. We were interested in this. It sounded like a good idea.

But we did not realize what a game changer it was going to be. We had, I won't get into too much detail, but we had a we had a multiple revenue problems. We had a census problem. We had a collection problem. We had a we had a capturing the revenue in the first place problem and making sure to do it correctly in Eldermark. So if if there was a problem, we had it. And, so all of those things were affecting our cash flow.

So, some of those things we fixed over time and and they were incremental fixes and it helped and it eased some of our cash pain that we had.

But but all of it didn't help when we were still doing our old system that we talked about in the very beginning. So paper checks, and we needed to count on people in the communities not losing a check, not, we needed them to go like, we had to send reminders. Like, we had these Krista would send daily reminders.

Everybody go to the bank today. You know? Like, don't forget. You know? That kind of stuff just to get our cash in.

As as Mark was talking about, like, to make payroll, we needed to make sure every like, we were watching the cash come in every day. Like, okay. Did did this building put their cash in yet? Nope. They haven't been to the bank yet. Okay. Like, I mean, in insane, processes that, you know, we just had to do in order to, you know, make our bills.

Doing ePay gave us a very consistent and predictable, which is the big part, right? Even even before we moved everything to the beginning of the month, we just we just could predict, when the money was gonna come. And as more people, adopted it, it became more predictable. The other thing we did was that we did have some people that were, I I didn't mention at the beginning, but we did have some ACHs.

We we we did have some sort of manual right through our bank. And, but they over time, we allowed them to pick whatever date they wanted. So we had all we had these ACHs, you know, a small percentage of our ACHs, but some of them were picking the twenty eighth of the month. So we had we literally had probably I don't know, Krista.

Do we have at least twelve different twelve, fourteen different ACH dates?

And so you can I mean, the money's just trickling in all month with paper checks and ACHs? So we did, implement that we are only going to do three dates. We did do it, a couple of different dates. We, you know, we wanted to have there were some people that, you know, for whatever reason, they don't get their check until this day or whatever.

So we we did, like, first, fifth, and tenth. We still do have a few outliers. There's like five people that, like, for whatever reason, they're paying on the seventh. But what we did was, even the even the people that were, doing that, I would you know, the person paying on the seventh, I'm encouraging them to just pay on the tenth.

You know, it it it's, you know, a a small amount of money and it it allows us to only have three dates. So it's like if, but what's nice is, like you said, Alex, is that everything we were encouraging, all those, you know, the tenth is the latest. So the people that were paying on the fifteenth and the seventeenth, we moved them to the tenth. Almost everybody, I think we might have one person, Krista, that's still out there or maybe Alex even knows.

But but out of, you know, close to five hundred residents, we have maybe one person that pays past the tenth, in ePay and everybody else is the tenth or before.

And it's just been a game changer. So to answer your question, what are some of the things we're gonna do? Well, it's allowed us to, be able to plan, our accounts payable.

It, we, you know, we obviously when you have a revenue problem, you end up having a little bit of an accounts payable problem too. So we've been able to work on how we're going to pay routinely what our accounts payable looks like and been able to really, beef that up and make that look way prettier. Our vendors are happy because of that.

And I mean, that's that's the that's the immediate fix. But then the other one is we're able to just set better budgets. We were working off of some kind of a idea of what we wanted to to do, but we didn't have really tight budgets because we we didn't have a we didn't know what our revenue was consistently. Right?

So now we've been able to put budgets in place for the rest of this year and next year, which is also a game changer. So I would say those are the immediate things that I'm excited about. But just being able to count on the cash flow, you know, doesn't mean that daily we wake up saying, what are we gonna do today? How are we gonna pay today?

You know?

So, Krista, what have I missed or did I Yeah.

So I would say another component that going through this entire process has really helped us with is now that we are able to predict our cash flow in a better manner, we're at the point where we're able to now reopen a building that we had shuttered for a long period of time. So we know when we should be expecting that cash now, and we've been able to clean some things up, throughout the rest of the organization. So we're able to now reopen a building that was closed for over two years.

And the other piece of that that we're really excited about is now that we have some breathing room, we're also able to look at our private pay packages, and talk with Mark Anderson. We're in the middle of business model design right now so that we can have better private pay, levels of care, I guess, is what we will call them, going forward so that we're properly capturing the revenue for those individuals.

Yeah. That's great. And I know that we've got some case studies on business model design and how it ties in.

So if you guys haven't gotten that separately, I will absolutely send that to you. I'm so glad that you guys are going through that process.

So shifting over to our other panelists, Mark and Ashley, this might be too soon, but you guys have some mergers of equals that, of course, maybe ePay obviously wasn't the result of. But, you've gotta have that prediction of cash and money in the bank. Right? So anything that you can share, or is it a little too soon at this point?

Yeah. I don't I I can't really don't really know what's gonna happen on that front, but Yeah. Looking looking looking back and and trying to predict the future, you know, we've we've we've made some changes in the organization. We've taken on some management contracts. Some of our communities that used to have a business office manager don't anymore.

Some of those and and now all of that billing and cash management is handled at our corporate office.

We could not have done all of that. We would have had to hire additional people in order to manage that, and we haven't had to do that. And I think that's a direct result of of everything being on ePay. So as we look to the future, whether it's, you know, moving other properties that that we're now part of onto onto ElderMark or taking on additional management contracts, I think we're much better in a much better situation, better suited to take on those contracts from a business office perspective because of EPA.

Great. And, Ashley, I know that's been a direct correlation to you. I know that I've kind of alluded to this before, but you started out with a handful of communities and now you've really got your hands in all of the communities. So anything else that you might wanna add in how it's transformed your role and delegation of responsibilities?

It's really just been such a time saver and really helped with a lot of the collection efforts, especially as I've taken over some of the buildings that had, things that were much older in AR. So being able to to get that much faster, and the cleanup process at some of those communities has been helped a lot. And during our, like, restructuring of our department, like Mark said, we would have had to hire an entire additional person. And so that is incredible savings that we have had by not, needing to just spend all of that time. But overall, the residents are very happy and it makes all of us very happy also.

Yeah, great testament there. And then, Michael, I know I mentioned at the beginning that you guys have tremendous growth planned for twenty twenty five. Tell us a little bit more about that.

Yeah. We have about five new communities that'll be, transpiring here before the end of twenty twenty four. So our immediate focus is sort of seeing those acquisitions through, to fruition. And then twenty twenty five is shaping up to be, like I mentioned, our our biggest biggest year yet. And I think, you know, leveraging the experience of of all of the mistakes that we've made along the way and really, really learning from them and making our processes more efficient and more streamlined.

One, you know, item I was gonna mention is we're we're senior housing operators. We're not collection specialists. So, you know, being able to get, sort of a one size fits all system in place that allows the communities to focus more on the residents and and what our job really is there instead of, you know, knocking on doors and and making outbound phone calls that doesn't feel very good. And, you know, I I talk a lot about how, you know, we're we're operators.

We're not an accounting firm, and we're not a collection call center. And so this in, you know, entire system has allowed us to get time back to focus on what we do best, which is why we're in this industry to operate senior housing assets and, you know, and and help take care of our residents and and do do what our job really is. So I think, you know, in summary, being able to free ourselves up and, you know, the other piece that someone had mentioned that they had done away with, you know, business office, directors in some of the communities. We, as a management company, really take on all of the cash management, all of the AP, all of the AR, and all of the payroll here at our corporate office.

So it really allows the community to get get back, you know, time that's much needed. And then the other thing that I think is a big value of our company is we take that all on and that's included in our management fee. And we don't expense that down to the ownership groups who have other operators in this space who do just that. And so we we really leverage ourselves as a lean group, and and it's beneficial for our communities, beneficial for our ownership groups.

And then, you know, that's what we were hired to do, and I think that's where our our value is really created.

Yeah. That's amazing. I'm super excited to be a part of that growth with you and, all of our other panelists that are here. We've loved having a firsthand seat at walking through your guys' growth, not just in twenty twenty four. For some of us, we've been partnered for many years before that, too. But, but really before we wrap things up, just wanted to give a big thank you and shout out to our panelists.

I know I mentioned this before, but we understand how important it is to handle your residents and family payments.

And we appreciate the trust that you've placed in ElderMark to do that. So thanks for taking the time to participate today.

We know that time is valuable and we really do appreciate your willingness to share your experience.

I'd also like to extend a big thanks to our attendees for joining us, whether you're already using ElderMark or you might just be checking us out. I hope that you found today's discussion valuable as we explore the electronic payments landscape and how to drive adoption within your communities.

Now, for those of you interested in learning more, I am pulling back up the contact information for Ben and myself.

If you are not using Eldermark, but you're interested, Ben would be your best point of contact. And for those of you that are already using Eldermark, and ePay services, don't hesitate to reach out to me directly.

And we are more than happy to help you take that next step in boosting adoption in your sites. So, thank you again, everyone for spending time. We appreciate it. We'll open it up for questions and answers.

And then otherwise, beyond that, have a great rest of your day, and we will see you soon.

So now we are going to jump right into our q and a here.

And listening, I know some of that may have sparked some additional questions for some of you. So before we wrap up, we are gonna open up q and a. You should see a chat option and a, q and a option on your screen if anyone has any questions they do wanna ask.

Let's see here.

Alright. One is coming already.

Let's see. How long does it take to set up ePay? So ePay takes typically about, two weeks to get you approved for the account to start accepting payments.

From there, we have trainers, that will spend the first few billing cycles with you to make sure that, they go well.

So to get set up, it's about two or three weeks, and then we work with you for another three months on training, making sure everything goes smoothly.

Any other questions?

K. Got another one here.

Cards are expensive, and we don't wanna take on the cost. Is there any way to pass that on to residents?

Yes. So in addition to ACH, we do credit cards as well. We have two options for credit cards. One is the traditional processing fees where you guys take on the cost. We also have a surcharging ability where, if someone goes to make a card payment, they are charged an additional fee just to cover the cost of processing. We make we make sure that's all clear clearly stated when they go to make that payment, just so there's no surprises.

Alright. One more.

I have a small community. Does ePay make sense for me?

Yes. Yeah. If if you're taking payments of any sort, which I hope all the all of you guys are, then, yes, ePay would work for you. You know, we primarily handle private pay, but no matter what size or how many residents you have on private pay, we can help with that. So, yeah, no matter the size, whether you have five units or, you know, five thousand units, ePay can be a good fit for you.

So, yeah, if there are no more questions, or if there's any questions you didn't have, you wanted to, hear more and see more about eBay, you can reach out to Alex and myself here, and we'll talk more about how eBay can fit into your unique community.

But other than that, that's that's that. Thank you everybody for joining. We are here for you guys as a resource if you ever, have any questions or wanna learn more. Thank you, and, have a great day.